TEAM ESTATES Buying Selling Investing

WE HELP YOU

Buy Better. Sell Smarter. Invest Stronger.

Your property. your goals. our mission

SAVVY. SEAMLESS. SOLD.

Meet the expert

Empowering your next move in real estate

Buying

Buying a home can be daunting. Whether you're a first-time buyer or seasoned pro, our team is here to help.

Selling

Selling a home is a major financial and emotional decision and we are here to make sure you make the right one.

Investing

We provide a customized approach to each investment opportunity and financially plan what can lie ahead.

Cash Offer

We will not only provide a CASH OFFER, but will also go over ALL your available options to sell.

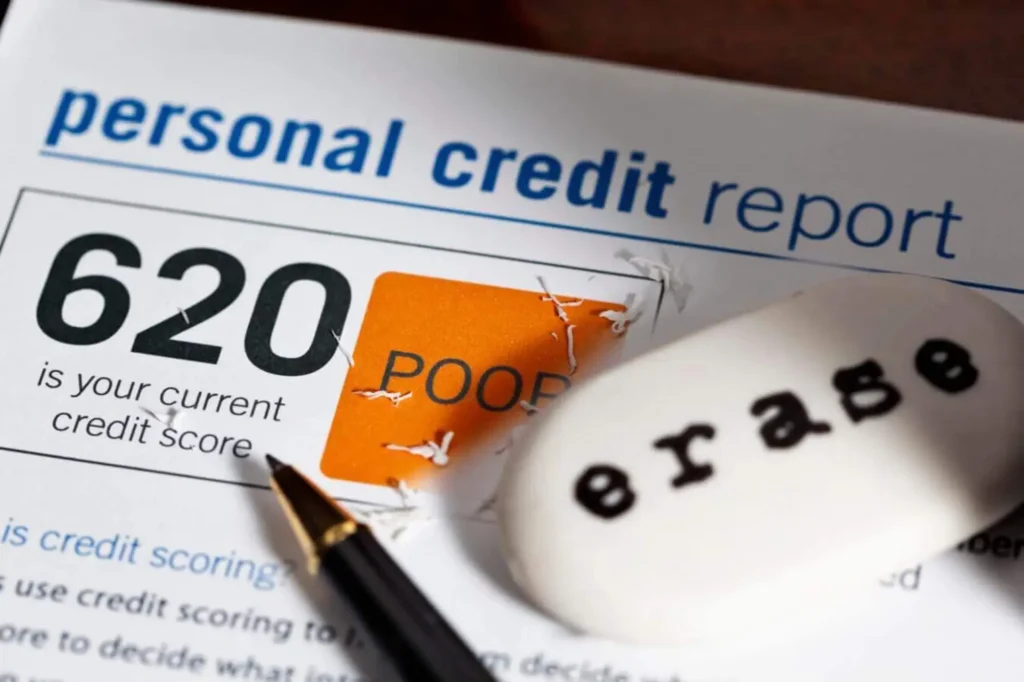

Credit Repair

It is a process of taking proactive measures to address any perceived or actual errors on your credit report.

Your Path to Real Estate Success

Consultation & Planning

Understanding goals, budget, and market insights.

Personalized Solutions

Tailored strategies for buying, selling and investing.

Closing & Success

Smooth transactions with expert guidance and support.

Making Moves, Building Futures

At Team Estates, Inc., we do more than just buy and sell homes—we help you build a secure future. With expert guidance, market insights, and a client-first approach, we ensure every real estate move is a smart and successful one.

Home

Buyer Programs

Renting vs Owning

Expert Real Estate advisor

Hatim Bilal has extensive experience in real estate, mortgages, title and banking. Licensed since 2005, he built a trusted and successful real estate business.

Client-Focused Service

Team Estates, Inc. prioritizes trust, transparency, and customer satisfaction. They help clients confidently navigate the real estate market with confidence and ease.

Wealth-Building Strategies

Helping clients build long-term wealth through smart real estate investments. They provide expert advice to make informed and profitable decisions.

Home

Buyer Programs

Expert Real Estate advisor

Hatim Bilal has extensive experience in real estate, mortgages, title and banking. Licensed since 2005, he built a trusted and successful real estate business.

Client-Focused Service

Team Estates, Inc. prioritizes trust, transparency, and customer satisfaction. They help clients confidently navigate the real estate market with confidence and ease.

Wealth-Building Strategies

Helping clients build long-term wealth through smart real estate investments. They provide expert advice to make informed and profitable decisions.

Frequently Asked Questions

Satisfied Clients

Verified Hatim was great. He purchased my home As is and it was a quick process. He’s very knowledgeable and an awesome person to work with. Definitely an Asset to have and utilize. I’ll recommend him to anyone looking to buy, sell or simply invest. Thanks!Verified Hatim did a fantastic job helping us to sell my aunt’s home quickly. He was incredibly efficient, kind, and made a very stressful situation go smoothly. He had all the information right at hand and having not done this before he was such a great resource to us. I would highly recommend him. We were extremely pleased with the quick outcome. Thanks Hatim!Verified Hatim was very helpful with the sale of my father's home. He was quick, professional, and easy to work with. I would definitely recommend him to others!Verified Hatim bought my house to rehab and sell (which is not an option here in “Service Provided” so I chose “consulted”). It was a truly first rate experience. Hatim saw my house, made a same day offer and closed exactly on time. He was upbeat, helpful, and negotiated a fair market price for my “as is” property. He always answered my questions promptly, communication was excellent. I look forward to working with Hatim if I buy another home in Minnesota, and I would highly recommend him to anyone looking to sell a property.Verified I'm so glad to work with him. I went through two others before I decided to go with him!!! He's honest with his options, he was very patient, no rushing, and friendly. Easy going person to get along with!!!! He even gave us the best house warming gift anyone could ask for. Thank you so much for your hard work and putting up with the pickiest person ever! My realtor is better than yours!!!!Verified Hatim is the realtor who will help you find your home and not just try to sell you the property. He is not only a fun guy to work with, but a true professional with an in-depth knowledge and experience in Real Estate. Hatim did a great job of listening to what was important to us, and then, using his in-depth knowledge of the marketplace, provided us with many good options. He offered excellent advice and suggestions. Hatim was very accessible, answered phone calls quickly and was available for showing whenever we asked, he was always on time. During the entire process we felt like we were his only clients. Hatim provided excellent services in a patient and professional way, he always put ALL the facts in front of us about the property, he was very honest. Several properties didn't work out for one reason or another however he was always patient, full of humor and helped to keep our Moral high to find a Home. He shown us every property with same energy and joy. Finally, Hatim helped us to find our Home, We are very happy and blessed with our home. His knowledge of construction, building codes, home inspections, and contract negotiations is very impressive. Most importantly he knows the market very well and will talk straight with you about the market situation. He is thorough with all of his work and patient to answer any questions. He knows the bankers and mortgage officers, appraisers, and all the people who perform their parts in the real estate transaction. Even after the transactions, Hatim is always available to answer any questions and suggestions on home improvements. I recommended him to my Boss, Colleagues and friends and would recommend him to any buyer or sellerVerified Hatim is as honest and upbeat as anyone I've ever met. He tells it like it is and worked hard to get the perfect house for me. I am extremely satisfied and I'd work with him again in a heartbeat. He is great.Verified Hatim is fabulous. I began my search in October and found my home in February and he was always there for me with advice and encouragement. I know I looked at minimum of 100 homes and I was very particular about the home I wanted and wanted within my budget. Hatim stuck with me through all of it even when I was ready to throw in the towel on the search, thinking I would not find it. But when my house finally came on the market he went to bat immediatly to make sure I didn't miss my opportunity. I got everything I wanted and in my budget. Hatim is very caring and honest looking out for his clients best interest which is sadly a very rare thing in todays business world. I highly recommend him to anyone looking to buy or sell. A great realtor and now, someone I can call a great friend too.Verified Our experience with Hatim Bilal was wonderful. He was always there to answer any questions or concerns we had and always made himself available anytime we wanted to look at a house. He is very knowledgable and he honestly does care and it shows. When I found myself getting discouraged, he kept me focused on the big picture and alway reasured me that everything was going to be ok. Now, I can say we are the proud owner's of the towhome of our dreams. Thanks to Hatim!!Verified Hatim was immediately available for me every time I wanted to see a house, he guided me through the process every step of the way, and we arrived at a price that was good for everyone involved.