Investing

Let the MONEY work for YOU!

Team Estates realizes the value of hard-earned money from our investors and we strive to provide total transparency for every deal we undertake. Along with presenting a variety of investment options to enable our investors to make safe and informed decisions. Although the risk is involved in every transaction. We analyze all the angles to ensure your investment is protected by providing non-biased opinions and exit strategies. We provide a customized approach to each investment opportunity and financially plan what can lie ahead. That puts our clients at ease knowing what to expect upfront. The result is a personalized plan that is closely monitored to achieve your goals.

Real Estate Investment Strategies

Investing in real estate can be a great way to generate income and build wealth. When it comes to investing in real estate, there are many different strategies and investing styles to choose from.

Fix and Flip Strategy:

This strategy is a short-term approach that involves purchasing a property, renovating it, and then quickly selling it for a profit.

House Hacking:

This strategy involves living in one unit of a multi-unit property while renting out the other units. The rental income pays for most or all of your housing expenses.

Short-Term Rentals:

This is a real estate investment strategy in which an investor buys a property and rents it out on a short-term basis, such as with Airbnb. The investor typically tries to maximize profits while also balancing the risk associated with dealing with tenants.

Section 8 & Government-Backed Housing:

Secure steady income by renting to tenants with housing vouchers, ensuring guaranteed payments and reduced vacancy risk. Invest in new construction homes in high-demand areas with strong appreciation potential to build long-term rental wealth and maximize your returns.

Multi-Family Investing:

This strategy involves investing in multiple properties at once. It allows investors to greatly scale up their rental income quickly.

Private Money Lending:

This strategy involves lending money for real estate investments. It can be a great way to generate passive income while also avoiding some of the hassles of traditional real estate investing.

REITs:

Real estate investment trusts (REITs) are publicly traded companies that invest in a portfolio of real estate holdings and use the income from those investments to pay their shareholders dividends. REITs are available to all investors, regardless of their capital.

Senior Living Facilities:

Capitalize on the growing demand from an aging population by converting or developing properties into senior living or assisted living facilities. This niche offers long-term, recession-resistant income for investors, driven by demographic trends and the ongoing need for quality elder care housing solutions.

TAX Benefits of Investing in Real Estate

Depreciation:

Expense Deductions:

Capital Gains Exclusion:

1031 Exchange:

Tax Credits:

Passive Losses:

Property Tax Benefits:

Asset Protection:

Real Returns, Real Assets

Real estate is a tangible asset that can produce income while also providing potential capital appreciation. As such, it can be an attractive investment vehicle for many investors. Financial analysis of real estate investments can help identify the most attractive opportunities and provide insights into the relative risk and returns associated with those investments.

When analyzing real estate investments, investors must consider both macroeconomic factors, such as economic trends, population growth, and changes in financing terms, as well as microeconomic factors, such as local market conditions, construction and renovation costs, rental income, and operating expenses. They may use various financial techniques, such as forecasting, discounted cash flow analysis, and cost/benefit analysis, to assess the risks and returns associated with the property.

The real estate market is inherently cyclical, so investors need to factor this into their analysis. It is important to understand the economic climate, including economic policies and conditions, in order to select the most appropriate investments for that particular environment. Investors should also take into account the location of the property and any local zoning, taxation, or other regulations that may affect the return on investment.

Investors should also consider the downside risks associated with real estate investments. These may include volatile markets, periods of low occupancy, and tenant turnover. Additionally, investors should understand the potential environmental, physical, and legal risks that could occur, such as contaminated property or inadequate disclosure of information.

Ultimately, investors must balance their goals and risk tolerance when deciding whether to make a real estate investment. With thoughtful research and analysis, real estate investments have the potential to produce attractive long-term returns.

Key Factors to Consider When Investing

Location

Location is one of the most important factors to consider when investing in real estate. Choose locations that have a good track record of appreciation, have access to amenities, and are in desirable school districts.

Cash Flow

A rental property should generate positive cash flow—meaning the rental income should cover all of the expenses associated with the property, such as mortgage payments, taxes, insurance, and maintenance.

Property Condition

Investing in properties in need of renovations requires extra attention to detail. Make sure to factor in the cost of any renovations that need to be completed before the property can be rented out.

Financing

Evaluate several loan programs to find the one that best meets your needs. Consider both interest rate and repayment terms.

Legal Issues

Investigate the legal issues and potential challenges before finalizing a purchase. Have a qualified real estate attorney review the purchase contract and title report.

Tax Implications

Understand the tax implications of owning a rental property. Consult an accountant to ensure you can maximize your deductions.

Strategic Wealth Growth Planning

Trusts & Estate Planning:

Use legal structures to protect your real estate assets and ensure smooth wealth transfer for future generations.

Smart Tax & Investment Strategies:

We help individuals at all financial levels structure real estate investments to minimize tax liability while maximizing returns.

Cost Segregation & Depreciation:

Accelerate depreciation on investment properties to offset taxable income and boost cash flow. Many investors use this to legally reduce their tax liability while still profiting from their properties.

Tax Planning:

Work with experts to minimize tax burdens and keep more of your hard-earned profits by leveraging powerful tools like Roth IRAs, Self-Directed 401(k)s, Health Savings Accounts (HSAs), Defined Benefit Plans, and SEP IRAs to strategically grow and protect your wealth.

LLC's & Asset Protection:

Many investors structure their real estate holdings in LLC's to limit liability and protect personal assets.

Customized Wealth Growth Plans:

Whether you're just starting out or looking to expand your portfolio, our strategies align with your unique financial goals.

Leveraging Real Estate Equity:

Wealthy investors often use home equity lines of credit (HELOCs) or cash-out refinances to reinvest in more properties, allowing them to scale their portfolios without tying up personal cash.

Opportunity Zones:

Reduce and defer capital gains taxes while investing in designated areas with high growth potential. These areas can also benefit from a tax abatement allowing investors to significantly reduce or eliminate property taxes an incentive for building or redeveloping in targeted areas.

Financial Metrics that Matter

Discounted Cash Flow Analysis:

This method uses the time value of money to determine a property’s worth based on projected cash flows generated by the investment.

Comparative Market Analysis:

This technique uses the sales prices of comparable properties to estimate a property’s value.

Replacement Cost Analysis:

This method looks at the cost to rebuild or replace an existing structure with a new one to value a property.

Capitalization Rate Analysis:

This method uses the ratio between the property’s net operating income and the current market value of the asset to calculate its worth.

Gross Rent Multiplier Analysis:

This technique multiplies the gross rental income of a property by a predetermined factor to assess its market value.

Real Options Analysis:

This approach considers the potential upside or downside of a real estate investment, including the opportunity costs of license, lease or expansion options.

Cost-Benefit Analysis:

This technique looks at both the costs and the benefits associated with an investment to assess its overall effectiveness.

Competitive Market Analysis

- Cash Flow Analysis

- Equity Analysis

- Appreciation Analysis

- Market Rent Analysis

- Net Operating Income (NOI) Analysis

- Real Estate Capitalization Rate Analysis

- Tax Analysis

- Risk Analysis

- Breakeven Analysis

- Marketability Analysis

- Loan-to-Value Analysis

- Debt Service Coverage Ratio Analysis

- Rent Roll Analysis

- Pro Forma Analysis

- Sensitivity Analysis

- Financial Feasibility Analysis

- Exit Strategy Analysis

Financing Options for Real Estate Investors

Financing Options for Real Estate Investors

Traditional Bank Loans: One of the most common ways to finance real estate investments is through traditional bank loans, which may include a variety of types such as fixed-rate mortgages and adjustable-rate mortgages.

Private Financing: This type of financing involves borrowing money from private lenders, often individuals or investment groups. Private financing can be used for a variety of purposes, including purchasing investment properties.

Hard Money Lenders: Hard money lenders are companies or individuals that lend money secured by real estate. These lenders may provide short-term loans and have higher interest rates than traditional banks.

Home Equity Loans: Home equity loans allow homeowners to borrow against the equity in their home. These loans can be used to finance real estate investments, including purchase and renovation costs.

Lines of Credit: Lines of credit are another way to access funds without having to make a loan commitment. Credit lines are often used by real estate investors to fund specific projects, such as renovations.

Crowdfunding: Crowdfunding is an increasingly popular method for real estate investors to source capital from multiple investors. Through crowdfunding platforms, individuals can pool together money to fund large projects.

Government Programs: There are various government programs for real estate investors, such as the Small Business Administration’s Section 504 Loan Program and the Federal Housing Administration’s 203(k) Rehab Loan Program. These programs provide access to low-interest rate financing for certain types of real estate investments.

Managing Risk in Real Estate Investing

Find the Right Investment Property

Diversify your investments: Investing in multiple properties reduces risk by spreading it among different geographies, markets and types of properties. It also gives you access to different sources of revenue, which can help minimize the impact of any unforeseen circumstances.

Research the local market: Understand the local market before you invest in a property. Review sales and rental data in the area, as well as vacancy rates, tenant demographics, average rent prices and growth trends. This will help you properly assess the risks associated with the investment.

Work with experienced professionals: Working with an experienced real estate agent, lawyer, or financial adviser can help you make informed decisions about investing in real estate. They can guide you through the entire process, from choosing a property to managing it once you become an owner.

Pre-screen tenants: Establish clear criteria for potential tenants in order to determine who is most likely to be a responsible renter. Always do a thorough background check, including references from previous landlords and an employment history.

Purchase property insurance: Property insurance helps protect your investment in case of unexpected events, such as vandalism, fire, or natural disasters. Many lenders require homeowners to maintain property insurance policies in order to protect their interests.

Manage your expenses: Make sure your rental income covers all your expenses, including repairs, maintenance, taxes and insurance. Consider setting aside extra funds each month into an emergency savings account to protect yourself in case of an unanticipated expense.

Plan for the future: Investing in real estate is a long-term commitment, so you should consider the length of your ownership when making decisions. Put together a plan for seasonal upgrades and repairs, and also consider what you would do if the market takes a downturn.

1031 Exchange

1031 Exchange

1. To qualify as a 1031 exchange, the properties must be similar in nature or use. The IRS defines a like-kind exchange as a “swap” of one property for another of a similar nature or one which produces income.

2. The 1031 exchange must be structured as an exchange rather than a sale. The investor must identify a replacement property within 45 days of the sale of the original property and close on the exchange within 180 days.

3. All proceeds from the sale of the original property must be held by a qualified intermediary or escrow agent until the new property is acquired. This is critical in order to maintain the tax-deferred status of the exchange.

4. The replacement property must be equal or greater in value than the property being sold and must have the same debt amount or higher as the property being sold.

5. Any excess proceeds received after the acquisition of the replacement property may be subject to capital gains taxes.

6. 1031 exchanges can be done multiple times with no limit on the number of properties exchanged. However, the exchange must be completed within 180 days of each sale.

7. Exchanges are particularly beneficial for investors who are looking to reinvest the proceeds from the sale of their initial property into a larger or more expensive property.

8. Investors can also use 1031 exchanges to acquire multiple properties at once. This is known as a “Starker exchange” and is commonly used by investors looking to diversify their investments.

9. The 1031 exchange can also be used by investors to relocate to a new state while deferring taxes.

10. Investors should consult a professional tax advisor to make sure that their 1031 exchange qualifies under IRS rules.

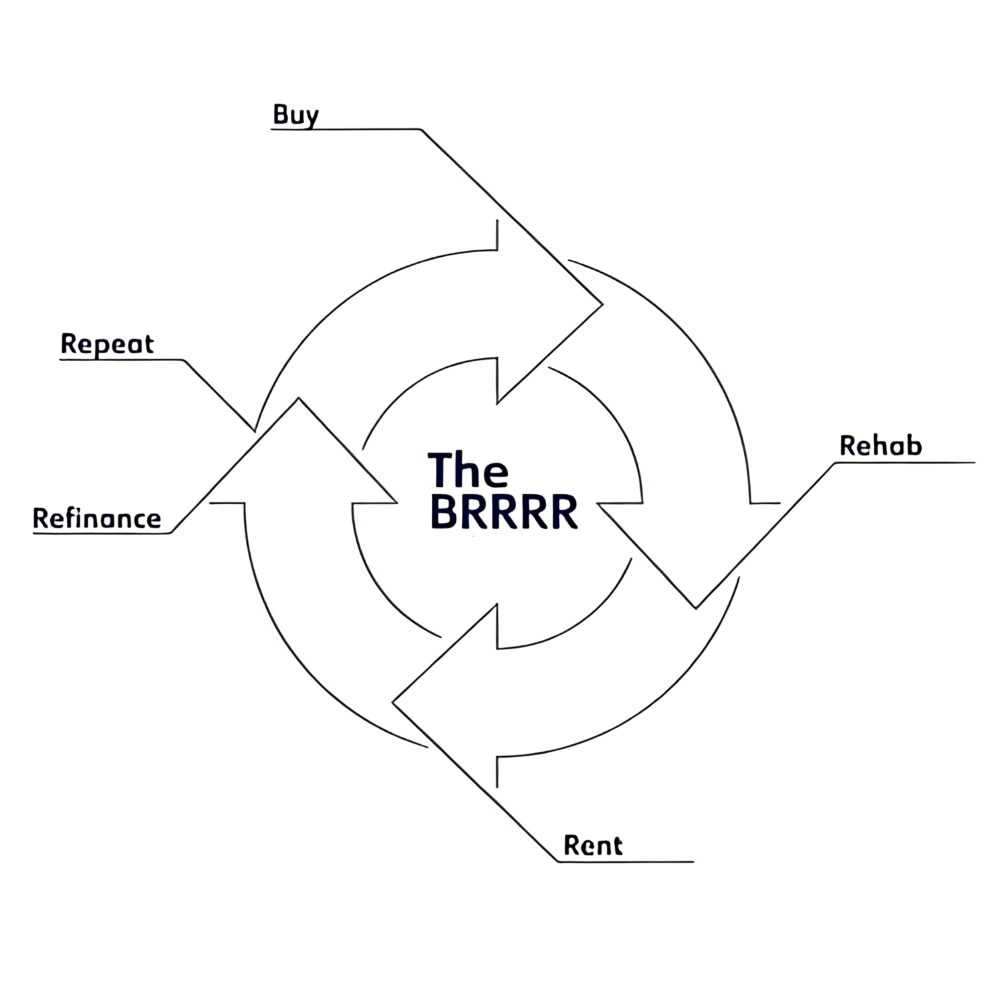

"BRRRR" Strategy Explained

The "BRRRR" method of Real Estate Investing

B – Buy: the first step of the BRRRR strategy is to purchase a real estate property. But not just any property will work, and you can’t enter into a contract without knowing what you are getting into. If you want to make money. Buying right is the first step. You must be certain that the property is a good value and you can afford it. When the rehab is complete you’ll have significant equity to tap into.

R – Rehab: the second step of the BRRRR strategy is to do necessary renovations or improvements. Although HGTV makes it look easy to rehab a property, it’s actually a lot of hard work. You’ll need a great eye for detail, a talented crew, and a good sense of what changes will improve your property value versus what will simply make it look nice. You also want to pull permits and stay in compliance with the city. This piece is by far the most important next to buying it for the right price.

R – Rent: the third step is to rent out the property to tenants. Now its time to rent out your now-completed rehabbed property to someone who will take care of it. This means choosing a tenant who won’t let you down from the start. A strong rental history, preferably good credit, and stable job history are key factors to look into while evaluating tenants. Getting the property fully rented is key to getting the next step done. Its also going to be important to your future profits so look for stable renters!

R – Refinance: the fourth step is to take out a loan on the property and use the rental income to pay it off. Now you are ready to shop around for a mortgage loan and refinance to pull all your equity out. Once your project is done and your renters are secure. You’ll talk to the bank about recapturing as much of the equity in your property as possible; typically 70%-80% of its current value. The bank in turn will need to conduct an appraisal, get a copy of your tenant’s lease, and more information about your own finances. They may also acquire an updated credit report. At the end however once you refinance you can get all the cash put back into your pocket and have a nice updated property that’s fully rented paying you every month.

R – Repeat: the fifth and last step is to start the process again and look for more real estate opportunities. Simply go back to the “B” in BRRRR, and work your way down. Before you choose your next property, it’s a great idea to go over the project you just completed and look at what things you did well and what things you could have done better. Being able to analyze the deal from the beginning to end gives you a much better understanding of what to do and avoid next time.

Leasing & Management

Leasing Services

Property Pricing

Property Marketing

Tenant Placement

Direct Deposit

Leasing Documentation

Management Services

- Rent Collection

- Pre/Post Inspections

- 24/7 Maintenance Requests

- Maintenance Requests

- Legal Compliance

- Accounting

- Eviction Assistance

Tenant Background Check

Income Verification

Employment History

Owner Approved or Denies Renter

Credit Check

Rental History

Criminal Background Check

Your Property, Our Priority

Our clients benefit from using us to lease and manage their real estate property because we provide a comprehensive suite of services that gives clients peace of mind. Our experts are trained in the most up-to-date techniques and technologies in the leasing and management field and will provide personalized attention to each of our clients. We take pride in keeping our clients informed by providing regular maintenance updates, financial reports, and responding quickly to any needs or questions our clients have. Additionally, our clients benefit from the security of dealing with a trusted partner that is dedicated to providing exceptional customer service and the highest level of care and consideration when it comes to leasing and managing their real estate property. To learn more about how you can become a client favorite. Call, text, or email us today!

Fix & Flip

Fixing and flipping real estate is a high-reward strategy that involves buying undervalued properties, renovating them and selling for profit. It’s an effective way to build wealth and expand your real estate portfolio but success requires market knowledge, accurate cost estimation, and strong project management. Investors must be able to secure funding, oversee renovations, and sell quickly to avoid prolonged holding costs. While flipping can yield quick returns, it comes with risks like unexpected repairs, market slowdowns, or contractor delays. This strategy is best suited for those with experience, financial flexibility, and a solid network of professionals. When done right, flipping properties can be both exciting and highly profitable.

Find the Right Investment Property

Find the Right Investment Property

Research the Local Market: Before investing in a property to flip, research the local real estate market to gain an understanding of the current trends and opportunities. Look at factors such as median house prices, inventory levels, and days on market to gain an understanding of the local market.

Consider Your Financing Options: Determine what kind of financing you will need for your investment property. Consider different loan programs, including short-term and long-term loans. If you plan to use private money from an investor, be sure to review the terms and conditions to make sure they align with your flipping strategy and goals.

Conduct a Property Evaluation: Once you’ve found a property that interests you, conduct a thorough evaluation of the home. Make sure to examine the condition of the property, consider any hidden costs or repairs needed, and look at comparable properties in the area to get an idea of how much it could be worth if renovated.

Negotiate a Good Deal: After evaluating the potential of the property, negotiate a good price for the home. Be willing to walk away from a deal if it isn’t going to be profitable in the long run.

Develop a Flipping Strategy: Before starting the flipping process, develop a strategy for the project. Decide which renovations need to be done, set a budget and timeline, and consider any potential risks of the project.

Renovation Risk

Renovation Risk

Financial Risk – The cost of labor and materials must be taken into consideration when budgeting for a renovation project, as even the best of plans can quickly become expensive. There is also the risk of unforeseen expenses that could arise during the renovation process.

Reputation Risk – Poorly performed renovations can lead to negative reviews or even legal action from unhappy customers. This can lead to decreased sales and potential damage to the business reputation.

Timing Risk – Delays in the project timeline can affect productivity and profitability. In some cases, regulatory approval or permitting may be required which can significantly extend the completion date of the project.

Zoning and Legal Risk – Before buying a property for the purpose of renovating it, the buyer should be aware of any potential zoning changes or legal issues that may arise.

Quality Risk – If the quality of the renovation is not up to standards, the value of the property may be compromised and sale opportunities may be lost.

Safety Risk – As with any construction process, there is always a risk of injury or worse to workers or buyers at the property.

Environmental Risk – Renovations may involve the use of hazardous materials such as lead paint, asbestos and other chemicals. These materials need to be managed and disposed of properly to avoid health risks.

Tips & Tricks

Tips & Tricks

Do your research: Before you even begin to think about investing in a property, you need to do your research, so you know exactly what’s going on in the real estate market. Research the types of deals being made in your area and assess potential risk factors that can affect the success of your investment.

Have a plan: Once you’ve done your research, create a plan for how you want to approach flipping properties. Consider your available resources, skill set and budget and come up with a strategy that will best help you reach your goals.

Take advantage of technology: Technology is making it easier for real estate flippers to find good deals and market their properties. Take advantage of online real estate platforms, social media, online marketing tools, and other resources that can help you be successful.

Network: Building relationships within the real estate community is essential for being successful as a real estate flipper. Join real estate groups and attend events so you can make contacts and learn more about the industry.

Be patient: Flipping properties is rarely a quick process, so be prepared to be patient when working with buyers and sellers. Don’t rush the process and take the time to ensure you are making sound decisions.

Have a team: Unless you are well-versed in all aspects of real estate, it’s best to build a team of professionals who can assist you. This could include a real estate agent, contractor, and accountant, so you have experts available to help you through the process.

Current Market Trends

Current Market Trends

Updated Kitchens and Bathrooms: Buyers are increasingly looking for updated kitchens and bathrooms. This includes new appliances, modern fixtures, tile or hardwood flooring, and plenty of storage space.

Open Floor Plans: Open floor plans are popular trends in home flipping as they create a more cohesive look and provide more natural light throughout the home.

Energy Efficiency and Smart Home Features: Smart home features such as voice-activated lights, automated thermostats, and Wi-Fi enabled outlets are becoming a must-have for modern buyers. Additionally, energy-efficient insulation, appliances, and windows can help attract eco-conscious buyers.

Neutral Paint Colors: Neutral paint colors like light gray, beige, and taupe are safer bets for captivating buyers as they are less likely to scare them away.

Natural Landscaping: Curb appeal is always a must in home flipping, and natural landscaping such as native grasses, flowers, and trees can be a great way to make your home stand out from the crowd.

Exit Strategies

- Auction or MLS

- Lease-to-Own

- Rental Investment

- CD Financing

- Seller Financing

- Joint Venture

- Agent Network

- Offer Incentives

- BRRRR Strategy

- Sell to Investor

- Creative Marketing